VMPL

New Delhi [India], September 5: When you require funds urgently but want to avoid breaking long-term investments or applying for unsecured loans, a loan against fixed deposit (FD) or a loan against mutual funds can be a practical solution. Both options allow you to borrow while retaining your investment, but each comes with its own benefits, risks, and eligibility requirements.

This article compares loans against FDs and mutual funds, helping you understand which option suits your financial situation better. Let us explore the key factors you must consider before borrowing against either instrument.

What is a loan against fixed deposit

A loan against fixed deposit is a secured borrowing option where your fixed deposit serves as collateral. Most banks and NBFCs offer this facility to FD holders, allowing you to borrow a certain percentage of the deposit amount–usually up to 90%.

As your FD remains intact, it continues to earn interest during the loan tenure. The interest rate on the loan is typically 1% to 2% higher than the interest rate offered on the FD.

What is a loan against mutual funds

A loan against mutual funds allows you to pledge mutual fund units in exchange for funds. This is offered by banks and non-banking financial companies through online or offline modes.

Lenders assess the value of your mutual fund holdings (equity or debt) and offer a line of credit, usually up to 50-70% of the current value. You can continue to earn returns on the pledged funds, although you may not be able to redeem them during the loan period.

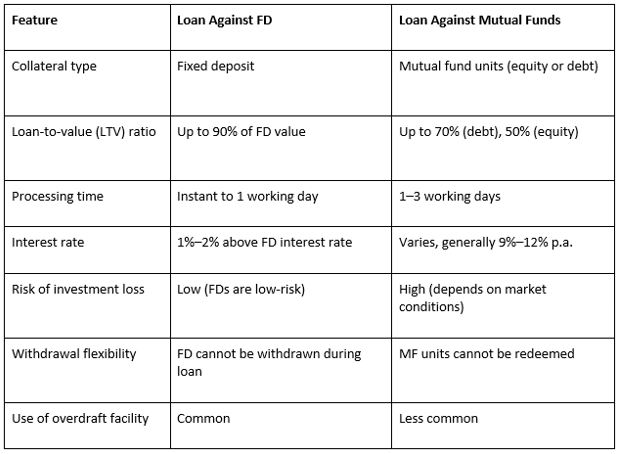

Key differences between the two :

Factors to consider before borrowing

1. Purpose of the loan

If you need a short-term loan for personal needs, a loan against fixed deposit may be quicker and easier. However, if your funds are invested in mutual funds and you want to retain exposure to markets, a loan against mutual funds can be considered.

2. Nature of investment

FDs are stable and offer guaranteed returns. Borrowing against them does not affect their value. Mutual funds, especially equity-based ones, are market-linked. If markets fall, the value of pledged units may reduce, affecting your loan eligibility and risk exposure.

3. Interest cost

Loans against FDs usually have lower interest rates since they are backed by guaranteed instruments. On the other hand, loans against mutual funds carry slightly higher interest rates due to market volatility and credit risk.

For example:

* FD return: 7.5% p.a.

* Loan rate: 8.5% to 9.5% p.a.

* Mutual fund loan: 9% to 12% p.a. depending on asset class

4. Loan amount and eligibility

FD loans allow higher loan-to-value ratios (up to 90%). Loans against mutual funds may offer only 50-70%, and this depends on the type of mutual fund (debt vs equity) and the fund’s current NAV.

5. Processing and documentation

Loan against FD is often pre-approved or can be availed instantly if the FD is held with the same institution. Mutual fund loans may require lien marking, fund verification, and may involve more documentation, especially if the investments are spread across AMCs.

6. Market volatility and risk

FDs are not affected by market movements, making loans against them low risk. Mutual fund loans come with a risk of falling NAV, which may trigger a margin call. If the value of pledged units drops significantly, you may have to pledge additional units or partially repay the loan.

7. Repayment flexibility

Most FD loans are structured as overdraft facilities, allowing interest-only payments with no fixed EMIs. Mutual fund loans can also be structured as overdrafts, but some lenders may offer term loans with EMI repayment.

Choose the structure that suits your cash flow and repayment ability.

When to choose loan against FD

* You have an active fixed deposit and need immediate liquidity.

* You want a loan with lower interest and faster approval.

* You do not want to disturb your long-term savings plan.

* You need a short-term overdraft facility to cover temporary cash flow issues.

When to choose loan against mutual funds

* You have a significant mutual fund portfolio and no FDs.

* You do not wish to redeem your units during a market correction.

* You are comfortable with short-term market risk.

* You are looking for higher loan amounts against existing equity or debt funds.

Tax implications

There is no tax exemption or deduction available on loans against FDs or mutual funds. However, since your investments remain intact, there is no capital gains tax triggered at the time of borrowing.

If you default on the loan or redeem the pledged units in future, normal capital gains tax rules will apply on mutual funds based on holding period and type of fund.

Tips before applying

* Check interest rate and processing fee from multiple lenders.

* Understand lien marking procedures, especially for mutual fund loans.

* Do not over-leverage–borrow only what you need.

* Monitor pledged asset value regularly to avoid margin calls.

* Maintain a repayment buffer to avoid liquidation of your assets.

Conclusion

Borrowing against your investments is a smart way to raise funds without disrupting your financial plan. Both fixed deposits and mutual funds offer loan options with distinct advantages and risks.

A loan against fixed deposit is simpler, quicker, and more secure, especially for conservative investors. A loan against mutual funds offers more flexibility and higher limits but comes with market-linked risks and relatively higher costs.

Before choosing either option, assess your liquidity need, risk appetite, and the stability of the underlying asset. This will help you make an informed borrowing decision that preserves your investments while supporting your short-term goals.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages